Is Slack Technologies (NYSE:WORK) Using Too Much Debt?

Famous fund manager Li Lu (who Charlie Munger backed) the moment mentioned, ‘The greatest investment threat is not the volatility of price ranges, but regardless of whether you will go through a long lasting loss of money.’ So it may possibly be apparent that you require to take into consideration debt, when you consider about how risky any provided inventory is, because as well significantly personal debt can sink a organization. We notice that Slack Technologies, Inc. (NYSE:Work) does have credit card debt on its balance sheet. But the serious dilemma is no matter if this credit card debt is producing the firm dangerous.

When Is Credit card debt A Dilemma?

Financial debt and other liabilities develop into dangerous for a business when it cannot quickly fulfill all those obligations, either with totally free hard cash movement or by boosting capital at an eye-catching cost. If factors get actually bad, the lenders can just take control of the business. Even so, a far more standard (but nonetheless high-priced) circumstance is where by a enterprise should dilute shareholders at a affordable share value only to get financial debt beneath command. Possessing stated that, the most widespread situation is in which a firm manages its credit card debt fairly perfectly – and to its possess edge. When we examine financial debt ranges, we 1st contemplate both of those money and credit card debt concentrations, together.

Look at out our most up-to-date analysis for Slack Systems

What Is Slack Technologies’s Internet Debt?

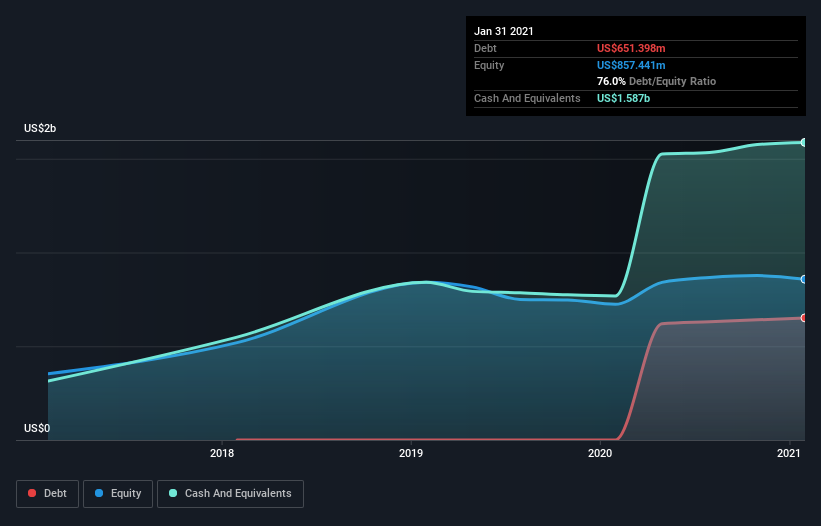

You can click the graphic below for the historic figures, but it demonstrates that as of January 2021 Slack Systems experienced US$651.4m of credit card debt, an increase on none, more than just one yr. But on the other hand it also has US$1.59b in funds, foremost to a US$935.9m net cash placement.

A Search At Slack Technologies’ Liabilities

Zooming in on the most current balance sheet info, we can see that Slack Systems had liabilities of US$697.1m owing inside 12 months and liabilities of US$879.1m owing outside of that. Offsetting these obligations, it experienced funds of US$1.59b as properly as receivables valued at US$237.4m thanks within 12 months. So it can boast US$248.4m much more liquid property than overall liabilities.

Having regard to Slack Technologies’ measurement, it seems that its liquid assets are perfectly well balanced with its full liabilities. So whilst it really is tricky to consider that the US$25.5b corporation is having difficulties for money, we continue to believe it is really really worth checking its harmony sheet. Merely place, the reality that Slack Systems has a lot more hard cash than financial debt is arguably a great sign that it can manage its financial debt safely and securely. The stability sheet is evidently the place to aim on when you are analysing personal debt. But finally the long run profitability of the business will make a decision if Slack Technologies can bolster its equilibrium sheet above time. So if you happen to be focused on the long run you can check out out this absolutely free report showing analyst financial gain forecasts.

In excess of 12 months, Slack Systems described earnings of US$903m, which is a acquire of 43%, even though it did not report any earnings right before fascination and tax. With any luck the organization will be ready to expand its way to profitability.

So How Dangerous Is Slack Systems?

Although Slack Systems shed dollars on an earnings in advance of interest and tax (EBIT) degree, it in fact produced optimistic totally free funds stream US$60m. So despite the fact that it is decline-producing, it would not appear to have far too a great deal close to-phrase harmony sheet chance, trying to keep in intellect the web cash. Preserving in head its 43% revenue advancement above the final yr, we believe you can find a good chance the business is on monitor. We’d see additional powerful development as an optimistic sign. When analysing personal debt levels, the equilibrium sheet is the evident put to start. Having said that, not all expense danger resides inside of the balance sheet – significantly from it. For illustration – Slack Technologies has 3 warning signals we consider you need to be aware of.

At the end of the day, it really is normally better to target on businesses that are no cost from net credit card debt. You can access our distinctive list of these kinds of providers (all with a track record of profit progress). It’s free of charge.

This short article by Simply just Wall St is common in nature. It does not represent a recommendation to invest in or market any stock, and does not get account of your aims, or your economic condition. We aim to provide you extensive-expression concentrated investigation pushed by elementary details. Take note that our examination may possibly not aspect in the most recent value-sensitive organization announcements or qualitative product. Basically Wall St has no position in any shares mentioned.

Have comments on this post? Involved about the articles? Get in touch with us right. Alternatively, email editorial-workforce (at) simplywallst.com.