Accsys Systems PLC (LON:AXS) shareholders may be anxious following seeing the share value fall 25% in the last quarter. But that doesn’t change the truth that the returns in excess of the previous five many years have been pleasing. Its return of 41% has absolutely bested the market place return! However not all shareholders will have held it for the long expression, so spare a believed for those caught in the 41% drop in excess of the last twelve months.

Let’s acquire a appear at the fundamental fundamentals in excess of the lengthier time period, and see if they’ve been constant with shareholders returns.

Watch our most up-to-date analysis for Accsys Systems

Although Accsys Systems manufactured a modest income, in the very last yr, we imagine that the current market is probably far more focussed on the best line progress at the instant. As a typical rule, we believe this sort of organization is far more similar to reduction-generating shares, due to the fact the precise profit is so low. It would be difficult to imagine in a more profitable potential without the need of escalating revenues.

For the past half ten years, Accsys Technologies can boast income development at a level of 16% per yr. That’s well previously mentioned most pre-revenue organizations. It can be good to see that the inventory has 7%, but not fully astonishing supplied profits exhibits solid progress. If you imagine there could be much more development to occur, now may possibly be the time to get a shut glance at Accsys Technologies. Of training course, you can expect to have to exploration the business additional absolutely to determine out if this is an interesting option.

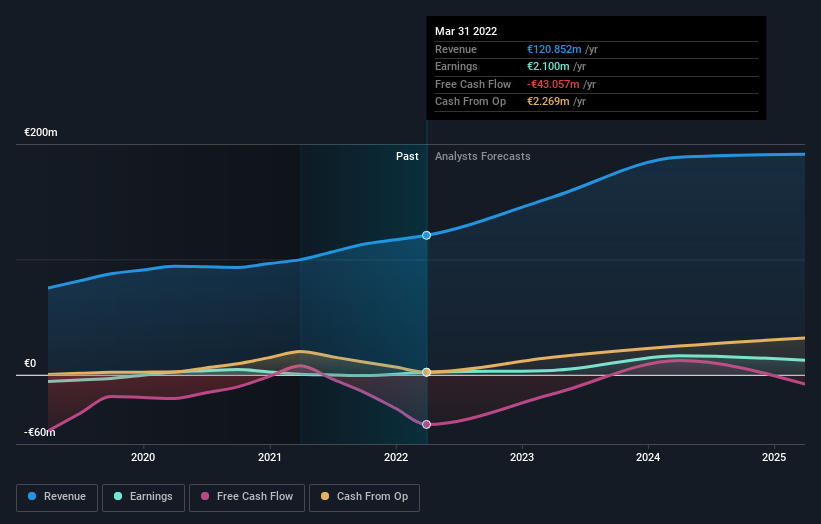

The graphic beneath depicts how earnings and revenue have adjusted in excess of time (unveil the precise values by clicking on the impression).

We know that Accsys Technologies has improved its base line above the very last a few many years, but what does the upcoming have in retail store? If you are pondering of buying or advertising Accsys Systems stock, you should really check out this Totally free in depth report on its harmony sheet.

A Unique Standpoint

When the broader market place lost about 6.1% in the twelve months, Accsys Systems shareholders did even worse, losing 41%. On the other hand, it could basically be that the share cost has been impacted by broader market jitters. It may be worth keeping an eye on the fundamentals, in situation you can find a excellent option. For a longer time expression investors would not be so upset, considering the fact that they would have made 7%, each year, over 5 several years. It could be that the latest provide-off is an possibility, so it could be value checking the essential info for signals of a long term progress trend. Although it is well well worth considering the distinctive impacts that sector problems can have on the share rate, there are other components that are even much more critical. Like challenges, for instance. Every single business has them, and we have spotted 3 warning signals for Accsys Systems (of which 1 is regarding!) you must know about.

For these who like to come across winning investments this free record of growing firms with recent insider obtaining, could be just the ticket.

Please observe, the sector returns quoted in this report reflect the sector weighted typical returns of stocks that at this time trade on GB exchanges.

Have responses on this article? Involved about the material? Get in touch with us right. Alternatively, email editorial-crew (at) simplywallst.com.

This report by Basically Wall St is common in mother nature. We give commentary dependent on historical information and analyst forecasts only utilizing an unbiased methodology and our posts are not supposed to be monetary advice. It does not constitute a recommendation to acquire or provide any stock, and does not acquire account of your objectives, or your monetary scenario. We goal to bring you lengthy-term targeted analysis pushed by basic facts. Notice that our investigation may perhaps not element in the latest cost-sensitive business bulletins or qualitative substance. Just Wall St has no placement in any stocks described.