Jonathan Knowles/DigitalVision via Getty Images

Invesco S&P Global Water Index ETF (NYSEARCA:CGW) offers exposure to a cohort of both U.S. and international, mostly developed markets stocks comprising 50 players at the moment. The themes its strategy is targeting are grouped in the water utilities & infrastructure and the water equipment & materials cohorts; the index it tracks is supposed to equally represent these two groups, with 25 constituents drawn from each. The portfolio has a sizeable allocation to small- and medium-sized companies.

All of these themes have strong long-term (multi-decade) bullish cases supported principally by the global population growth and subsequent consistent increases in demand for freshwater, allowing businesses involved in the development and manufacturing of relevant products and solutions to deliver steady revenue and cash flow growth, bolstering their intrinsic values.

However, shorter-term, most CGW holdings are exposed to re-evaluation as capital scarcity and the recession risk make investors reassess the value rotation we saw in 2021 and earlier this year. I believe the recent steep pullback in oil prices is one of the harbingers. So as we are approaching an era of capital shortages (lower capex, slower growth) amid central banks hurriedly boosting interest rates, I would not consider owning CGW or a fund with a similar focus.

It is worth understanding that the CGW portfolio is nothing but a mix of comparatively expensive stocks from mostly the industrial (48.5%) and utilities (42.5%) sectors, and though the latter is deemed defensive, the former is highly sensitive to economic activity. In case it goes downhill, not only will multiples compress, but weakening EBITDA will also be a strong reason for enterprise and market values to decline.

Below, using a sample from the ETF portfolio and harnessing the Seeking Alpha Quant data, I will illustrate why valuation is yet another risk for CGW investors in the current environment. Another issue with the ETF is that its FX exposure (more than 40% of the holdings are non-U.S.) is also a bearish factor should higher rates in the U.S. inflict more pressure on the pound sterling, the euro, the Swiss franc, etc.

Water is an essential commodity frequently overlooked

CGW’s investment mandate is to track the S&P Global Water Index. The constituents for the benchmark are drawn from the S&P Global BMI. Stock must be listed on a DM exchange; as can be seen from the index factsheet, this rule did not hinder three Chinese and one Brazilian company from qualifying for inclusion. CGW shuns small-caps with market values south of $250 million (and $100 million float-adjusted). There are also certain liquidity requirements.

The investment case for portfolios with exposure to the global water theme is comparatively easy to construct.

Water is an essential commodity, with demand for it increasing linearly following growth in the already sprawling global population. In the 2019 Nature article “Reassessing the projections of the World Water Development Report,” it was mentioned that global water demand for all uses that back then was approximately 4,600 km3 annually would climb by 20% in the worst case or by 30% in the best case by 2050, touching 6,000 km3. Meanwhile, this will be assisted by the global population rising to at least 9.4 billion or 10.2 billion people in the best case, “an increment of 22% to 32%.”

This creates an immense multi-generational opportunity and given EMs and frontier market countries are forecast to contribute most to these figures, water players with exposure to these regions are poised to reap solid benefits.

Besides, in its 2021 Investor Day presentation, Xylem (XYL), one of CGW’s largest holdings, highlighted that without significant interventions, “up to 40% of the world’s population will face absolute water scarcity,” while $40 billion worth of water is lost every year owing to damaged infrastructure or unauthorized use.

So, it is crystal clear that to mitigate the detrimental effects of these tendencies, substantial capital investments in infrastructure are required, creating a gigantic total addressable market for players involved and an attractive multi-decade bullish case for them. Does that make CGW a Buy at this juncture? I doubt that.

A closer look at the portfolio: Quant insights

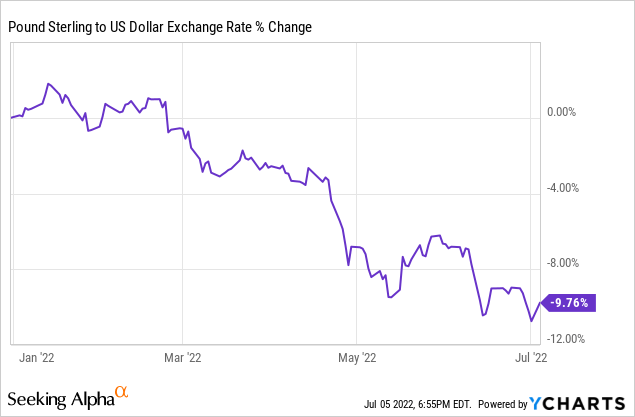

In the current iteration, CGW favors U.S. and U.K. stocks, with the former having over 59% weight and the latter having ~15.4%. Switzerland is in third place, with ~6.7%. The fund is underweight in Brazilian stocks, with just 1.5% deployed to them. I should reiterate that given the large allocation to non-U.S. equities, FX risk is not to be ignored by the CGW investors. For example, the pound sterling has been falling consistently this year, despite the Bank of England embarking on the path of interest rate increases earlier than the Fed.

This has certainly taken its toll on the global water fund’s returns and will continue eating into them should the U.S. dollar march higher.

Turning to the major holdings, CGW i

s concentrated in American Water Works (AWK), Xylem (XYL), and Essential Utilities (WTRG). The trio accounts for roughly 23% of the portfolio, with AWK having around 10.7% weight. AWK is also the top holding of CGW’s peer Invesco Water Resources Portfolio ETF (PHO), with a ~8.6% weight. First Trust Water ETF (FIW) is also overweight in AWK, with a 4.2% weight as of end-May.

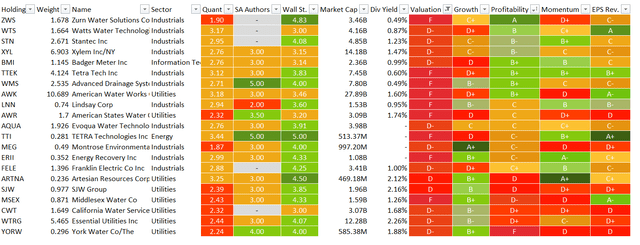

~64% of the portfolio has a Quant rating (I did not adjust any tickers this time). I suppose by analyzing this large cohort of holdings we can already draw a conclusion about whether the fund has valuation or quality issues or not.

I am dissatisfied with valuation as close to 48% of the net assets are deployed to grossly overpriced companies from the utilities, industrials, IT, and even energy sectors. Investing in cyclical companies that are priced at a premium to their sectors is a precarious step right now. This comparative overvaluation can be only partly explained by the size factor as most relatively expensive holdings are mid-caps (18 stocks, ~25% weight).

Created by the author using data from Seeking Alpha and the fund

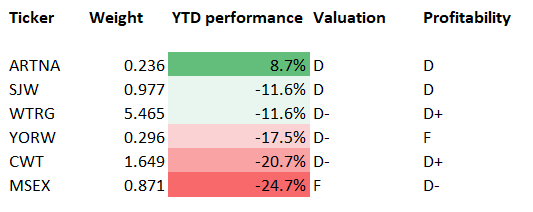

In this set, we also see six utilities (9.5% weight) with quality issues manifested in the Profitability grade being below or equal to D+. It would be pertinent to remark that most of these water utilities have declined steeply this year, with only Artesian Resources (ARTNA) being in the green.

Created by the author using data from Seeking Alpha and the fund

Final thoughts

There is a compelling case for global water based on the population growth, but the downside is that portfolios targeting players with exposure to this vital commodity are cyclical given the inevitable presence of industrials (and at times, materials) that depend on different end-markets, chemicals, and oil & gas included. Another downside is the valuation issues discussed above.

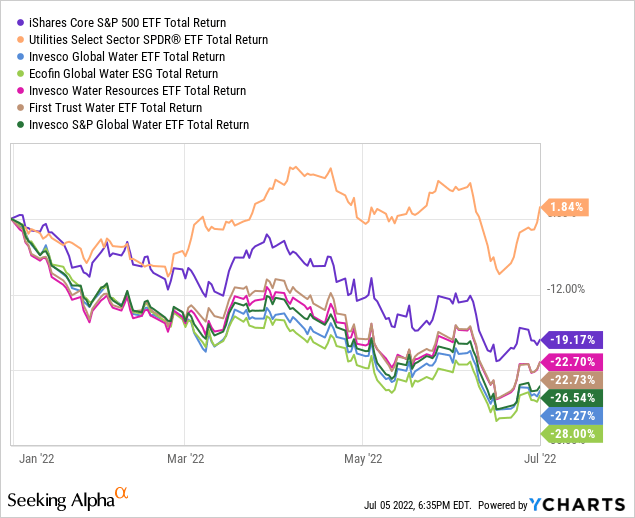

Apart from that, CGW’s performance this year has been simply dismal. Though overweight in utilities, CGW has seen an even steeper decline compared to the iShares Core S&P 500 ETF (IVV). Its peers FIW, PHO, and the Invesco Global Water ETF (PIO) have delivered similarly lackluster results, with Ecofin Global Water ESG Fund (EBLU) down the most.

So, unfortunately, despite an aura of defensiveness, CGW is not immune to steep pullbacks.

Examining why this could happen, I took a closer look at the YTD returns of the holdings analyzed above. I found out that just 4 stocks have been in the green, with TETRA Technologies (TTI) up by over 41%. Meanwhile, ~35% are down by over 20%, mostly industrials.

The question is why the fund is down so steeply while the Utilities Select Sector SPDR ETF (XLU) has managed to eke out a marginal gain? That happened probably because of electric utilities, which account for over 63% of the XLU portfolio, while water utilities have just a 2.4% weight.

Water utilities with a Quant rating present in CGW are down in double-digits YTD, except for ARNA and Companhia de Saneamento Básico do Estado de São Paulo (SBS).

That said, do not underestimate water players’ sensitivity to economic softness, especially those that are closely connected to the oil & gas capex cycle, like Select Energy Services (WTTR). Large exposure to utilities offers little protection, as the YTD performance has illustrated. A combination of global economic slowdown, FX risk, and relatively expensive valuation makes CGW a risky play. And by the way, its fees of 57 bps are on the expensive side. Shortly put, this ETF is a Hold at best.