Michael Vi/iStock Editorial via Getty Images

Big data analytics firm Palantir Technologies (NYSE:PLTR) experienced a rather difficult day on May 9th of this year. Despite reporting financial results that, for many firms, would have been considered stellar, the company saw its share price plummet because of what investors are viewing as a lowering of expectations in the near term. Normally, I would also knock the company but it’s important to note that management has not changed their own views on what the next few years for the company should look like. It is still true that shares of the company are rather lofty. But instead of the share price decline being attributed to a weaker long-term outlook for the company, the move lower appears to be more of an adjustment caused by the real fact that shares of the company, previously, looked rather expensive. Given the decline we have seen this year, combined with management’s own rosy view over the next few years, I would make the case that the stock still looks a bit pricey. However, with patience, it could very well pay off nicely.

A tough year so far

There’s no denying that 2022 is off to a difficult start. Year to date, the S&P 500, for instance, is down about 16%. During tough times like this, it should come as no surprise that expensive growth stocks would be some of the most negatively affected. One such player that fits that definition is Palantir Technologies. So far this year, shares of the company have plummeted by 59%. On May 9th alone, the decline was 21.3%. This echoes some of the concerns that I had about the company in an article that I wrote on April 19th of this year. At that time, I acknowledged the company’s rapid growth and robust cash flows. However, I ultimately said that the company was pricing on the last. This did not stop me from rating the company a ‘hold’, with the idea being that the rapid growth would more or less offset the high price. But it seems that even I, a generally conservative evaluator of stocks, was a bit too bullish on the company.

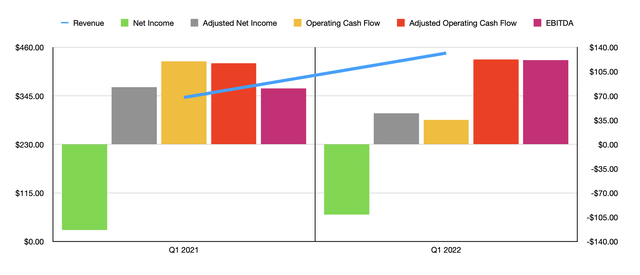

Author – SEC EDGAR Data

Given the decline that we have seen recently, you might think that fundamental performance for the company has been bad. But that could not be further from the truth. During the first quarter of its 2022 fiscal year, the company reported revenue of $446.4 million. That represents an increase of 30.8% over the $341.2 million generated just one year earlier. In addition to posting strong upside year-over-year, the company also beat analysts’ expectations to the tune of $2.85 million. Of the $105.1 million in additional sales the company experienced, 33.4 million came from government contracts, while the remaining 71.8 million was attributable to commercial clients. This 54% increase in commercial sales year-over-year brought commercial revenue up to 45.8% of the company’s overall revenue. That compares to the more modest 38.9% that the business attributed to commercial contracts one year earlier.

On the bottom line, things admittedly could have been better. Although the company did see its net loss improve year over year, narrowing from $123.5 million last year to $101.4 million this year, this still translated to a loss per share that missed by $0.02. Adjusted net income also worsened for the company, declining from $82.7 million in the first quarter last year to $44.7 million this year. In addition to this, operating cash flow for the company worsened. It ultimately dropped from $116.9 million in the first quarter of 2021 to $35.5 million the same time this year. If, however, we were to adjust for changes in working capital, we would have actually seen an increase from $80.7 million to $122.5 million. In addition to this, EBITDA also improved, albeit modestly, climbing from $119.8 million to $121.7 million.

Some of this seems to have been forgiven by the market. But where concerns really came into play was when the company announced expectations for the second quarter of this year. At present, they anticipate revenue of about $470 million. Although this represents a robust 25.1% increase over the $375.6 million generated one year earlier, it does fall considerably short of the $483.76 million analysts were previously anticipating. The big concern on this front is that management had previously forecasted revenue climbing at an annualized rate of at least 30% through the year 2025. Admittedly, such revenue increases will not be evenly distributed. In fact, a reasonable investor would expect for some of that growth to be frontloaded due to the advantage that smaller companies have in expanding their top lines compared to larger players.

If all we had was that guidance from management, I also would become more bearish on the company. Already when I last wrote about the firm, shares were quite lofty. However, management has also said that they still expect revenue to grow at an annualized rate of at least 30% through the 2025 timeframe. No, this may not come to pass. But the fact that management is still confident is a bonus for investors who do like the firm. And if it does come to pass, it would translate to revenue of $4.40 billion by the end of the time frame we’re looking at.

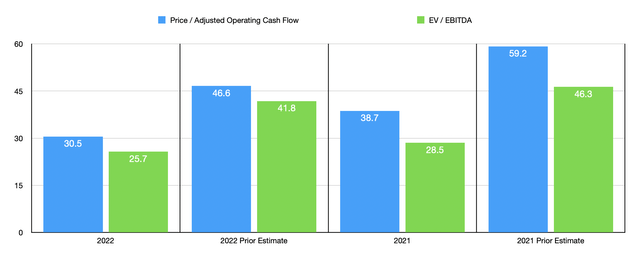

Author – SEC EDGAR Data

Given the significant decline in share price the company has seen, combined with the expectations management still has for the business, an attempt to revalue the company is in order. Just as I did in my last article on the company, I figured the best approach would be to look at a range of scenarios. I’m still assuming that sales growth will match 30% per annum and I’m still using the company’s adjusted operating margin as a proxy for both operating cash flow and EBITDA. Using this scenario, Palantir Technologies is trading at a forward multiple for the 2022 fiscal year at 30.5 on a price to adjusted operating cash flow basis. The EV to EBITDA multiple is even lower at 25.7. These numbers stack up against the 38.7 and 28.5, respectively, multiples the company traded at if we use their official 2021 results. Also, the significant decline in share price the business experienced translates to a significant reduction in the multiples, as you can see in the table above.

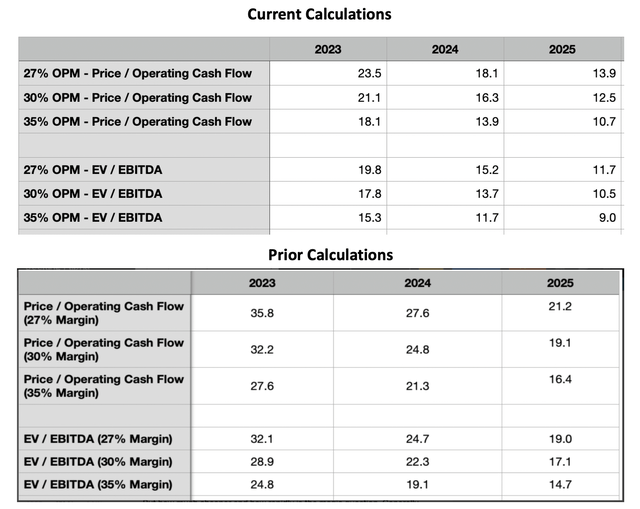

No matter how you stack it, shares of Palantir Technologies do still look pricey. However, that picture is starting to change. Using the same range of scenarios for the 2023 through 2025 fiscal years, you can see below that the company starts to look much more appealing rather quickly after this year is over. Assuming management can come through on their promises, even a scenario in which the adjusted operating margin matches the 27% the company anticipates for this year could result in its trading multiple becoming quite appealing for a rapidly growing enterprise by the end of 2024. By 2025, shares would look rather cheap.

Author – SEC EDGAR Data

Takeaway

I know investors in Palantir Technologies are rather disappointed. The sad truth is that this is the downside to investing in growth stocks. During times of turbulence and even when the company in question generates objectively strong performance, downside for disappointing investors in any way, shape, or form, can be extremely painful. The good news for investors is that management remains confident in their outlook for the company. Of course, investors should not take their prognostications as gospel. But for investors who do trust management and who don’t mind being patient, Palantir Technologies could now make for quite an attractive investment over the next few years. Even so, I am still rating the company a ‘hold’ because I am not a growth investor and because I still see the stock today as a bit lofty. But if the stock falls any further, I could very well change my stance on that.