NatanaelGinting/iStock via Getty Illustrations or photos

By Dina Ting, CFA, Head of World-wide Index Portfolio Management, Franklin Templeton Trade-Traded Cash

Can Japan spur political and economic coverage reforms in the aftermath of former Primary Minister Shinzo Abe’s tragic demise and the subsequent electoral victory for his ruling coalition? Dina Ting, our Head of Index Portfolio Administration, shares her sights on market place motorists.

Vital takeaways:

- With around 82% of its inhabitants vaccinated, Japan’s COVID-19 inoculation charge is among the the highest of G7 nations.

- The yen’s tumble to two-ten years lows could propel exports and enable quicken a rebound for its inbound vacation and tourism sector as Japan eases pandemic border constraints.

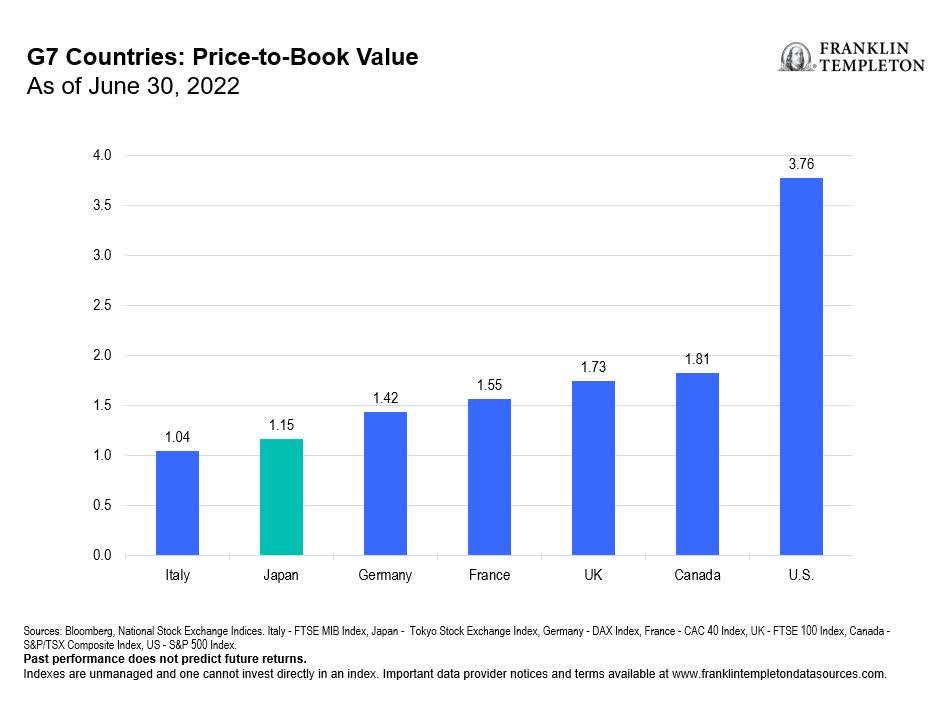

- Japanese equities are fairly undervalued relative to numerous other produced nations, and we feel Japan’s market place is worthy of a nearer search as a slice of investor portfolios.

It truly is a somewhat suspenseful time for Japan-watchers like ourselves as we try to gauge what is subsequent for the world’s 3rd-major economy. Practically a 10 years given that the Lender of Japan (BoJ) set its 2% inflation target, the country at last hit its mark in late May. Although prompted by greater electricity selling prices instead than domestic demand from customers, inflation might even now support psychologically jolt consumers from a very long-held deflationary way of thinking. Can the aftermath of former Key Minister Shinzo Abe’s tragic demise, and the subsequent electoral victory for his ruling coalition, also mark a turning point in Japan’s politics and plan? Even in this infamously greying culture, there are silver linings for its economic climate and for traders wanting to raise publicity to Japan at this time.

Momentum in Asia

Whilst world wide marketplaces have generally been bathed in crimson of late, we’ve found some positive momentum in Asia. China’s market place showed indications of advancement in June, however the around-term outlook for its stocks is one particular of cautious optimism. In the meantime, Japanese equities this year have fared notably far better than most of its developed market peers.

For the near term, it would seem Japan’s export price ranges may well continue being negatively impacted by ongoing offer chain constraints and greater costs for raw elements. Having said that, we feel a further soothing of pandemic limitations in China-its principal buying and selling companion-must offer tailwinds from noticeably pent-up demand. US Treasury Secretary Janet Yellen and Japanese Finance Minister Shunichi Suzuki agreed this thirty day period to operate jointly to enhance monetary balance and deal with volatility in forex marketplaces. Again in January when Japan and the United States publicly reaffirmed their partnership, they went as significantly as calling it “more powerful and further than at any time in its record.”

Approximately 82% of Japan’s population is now vaccinated, marking 1 of the greatest COVID-19 inoculation costs amid G7 nations. With the yen now at a refreshing 24-calendar year minimal against the US dollar, this export-pushed market place may perhaps be poised for a improve not only from its producing sector, but also from rebounding tourism. The beautiful trade level ought to help encourage back to Japan mainland Chinese visitors, which made up the biggest single group of tourists pre-pandemic.

In our examination, valuations for Japanese equities are at the moment beautiful relative to those of other produced marketplaces. On a cost-to-guide ratio, the Tokyo Inventory Exchange Index is buying and selling just below 1.2x reserve benefit, suggesting its equities are now greater valued when measured from other G7 international locations.

Structural reforms

There has been substantially modern assessment more than Abe’s signature economic system dubbed “Abenomics,” which yielded mixed final results. The country’s longest-serving prime minister is credited for propelling Japan’s company governance procedures further in line with world wide specifications. 8 a long time ago, his administration implemented key actions to attract additional foreign expense, demanding this sort of advancements as increased threat-administration disclosures and impartial external administrators. His successors ongoing to nudge this kind of reforms along and twice revised Japan’s Corporate Governance Code, initially in 2018 and once again previous summer to better advertise range, specifically in terms of women of all ages in leadership roles.

In our view, even so, modify can be sluggish in Japan and far additional of a shift is required. The code stopped quick of setting any certain targets, and Japanese females continue to lag the international average (27%) in their share of managerial roles (12%), in accordance to the Global Labor Organization.1 But pre-pandemic, the authorities was profitable in enacting laws to extend childcare, reform the tax code to reward dual earners, and boost parental depart procedures. We are inspired by Japan’s recent efforts to expand immigration procedures for international staff towards solving labor concerns as very well as for continued reforms to really encourage and advance females toward meaningful careers.

Abe’s legacy also still left a mark on the techniques in which some corporates interact with buyers and the sector in common. Shareholder returns, both in terms of dividends and share buybacks, are indicators of such good developments. According to Nikkei Asia, Japanese corporations are planning for stock buybacks to double to US$32 billion-its highest level in 16 decades and 1 which may perhaps aid bolster marketplace self confidence.2

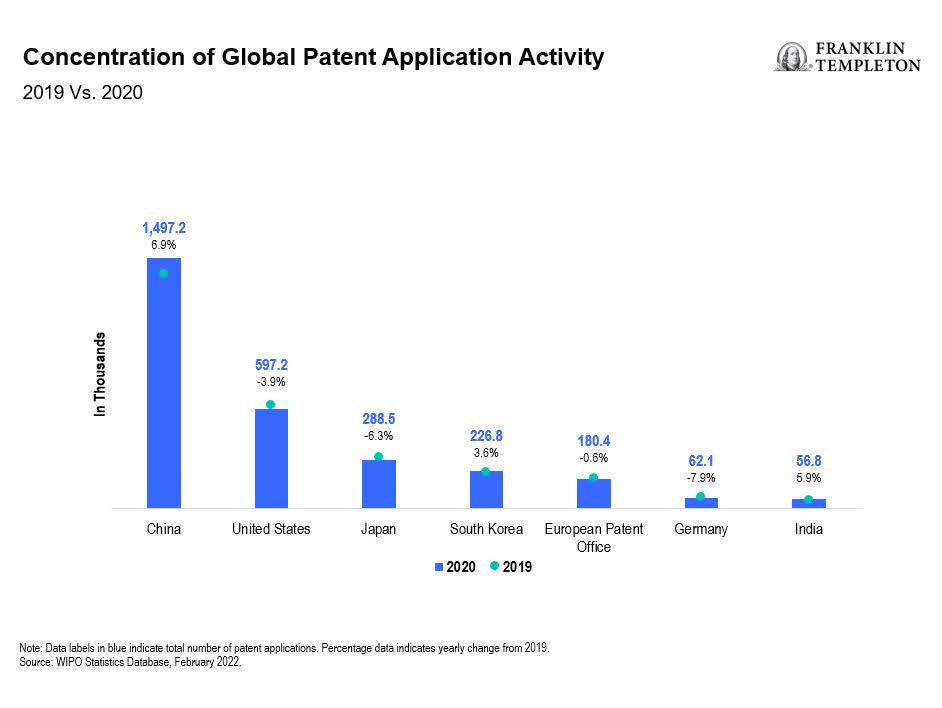

Japan has extensive grappled with demographics that can pose a drag on progress. But as the Intercontinental Monetary Fund (IMF) puts it, Japan is a “laboratory from which other nations are commencing to attract classes.”3 This involves Japan’s vital contributions to artificial intelligence (AI) and automation as the world’s top industrial robotics maker.4 Even with international provide hurdles, pandemic-induced desire for integrated robotics has spiked above the past two several years.

Japan has also persistently ranked significant between additional than 100 economies assessed for the World Economic Discussion board (WEF) World Competitiveness Index and has remained a top rated competitor in world patent exercise. Whilst Japan’s venture capital (VC) space may possibly nevertheless be chasing soon after not only Silicon Valley but also Europe, its VC landscape bought a improve previous yr amid the crackdown in China’s tech sector. There is now developing assist for strengthening Tokyo’s startup ecosystem, improved fostering entrepreneurship and embarking on a paradigm shift in policies to promote general economic revitalization.

What are the dangers?

All investments contain risks, such as the probable loss of principal. The benefit of investments can go down as properly as up, and traders may well not get back the total quantity invested. Stock price ranges fluctuate, occasionally promptly and considerably, due to factors affecting unique companies, distinct industries or sectors, or common industry circumstances. Investments in international securities entail specific challenges, which include forex fluctuations, economic instability and political developments. Investments in emerging marketplaces, of which frontier marketplaces are a subset, entail heightened hazards similar to the very same elements, in addition to people affiliated with these markets’ smaller sizing, lesser liquidity and absence of proven lawful, political, business and social frameworks to help securities marketplaces. Mainly because these frameworks are usually even significantly less made in frontier marketplaces, as well as several variables, like the elevated opportunity for excessive price volatility, illiquidity, trade barriers and exchange controls, the challenges related with emerging marketplaces are magnified in frontier markets. To the extent a approach focuses on specific countries, regions, industries, sectors or sorts of expense from time to time, it may perhaps be issue to better threats of adverse developments in these kinds of locations of aim than a method that invests in a broader selection of nations around the world, areas, industries, sectors or investments.

ETFs trade like shares, fluctuate in current market benefit and may trade previously mentioned or below the ETF’s net asset price. Brokerage commissions and ETF bills will cut down returns. ETF shares may well be acquired or sold during the working day at their marketplace value on the trade on which they are stated. Even so, there can be no promise that an energetic buying and selling market place for ETF shares will be formulated or preserved or that their listing will proceed or remain unchanged. Though the shares of ETFs are tradable on secondary markets, they might not easily trade in all sector ailments and may well trade at significant special discounts in durations of marketplace pressure.

1. Resource: International Labor Group, “Gender equality in the place of work continues to be elusive,” January 10, 2020.

2. Resource: NIKKEI Asia, “Japan stock buybacks double to $32bn, highest in 16 years,” June 5, 2022. There is no assurance that any estimate, forecast or projection will be realized.

3. Resource: Hong, Gee Hee, Schenider, Todd, “Shrinkonomics: Lessons from Japan, International Financial Fund, March 2020.

4. Supply: Global Federation of Robotics, “Japan is World’s range a single Robot Maker,” March 10, 2022.

Editor’s Take note: The summary bullets for this article had been decided on by Trying to get Alpha editors.