With its stock down 41% above the earlier 3 months, it is easy to disregard Rectifier Technologies (ASX:RFT). Nevertheless, stock price ranges are generally driven by a company’s financials more than the long phrase, which in this circumstance look pretty respectable. Specially, we determined to examine Rectifier Technologies’ ROE in this short article.

Return on equity or ROE is an important aspect to be considered by a shareholder because it tells them how successfully their money is getting reinvested. Basically put, it is made use of to evaluate the profitability of a company in relation to its equity funds.

See our most up-to-date evaluation for Rectifier Systems

How Do You Compute Return On Fairness?

The method for return on equity is:

Return on Fairness = Net Gain (from continuing functions) ÷ Shareholders’ Fairness

So, based mostly on the higher than method, the ROE for Rectifier Systems is:

3.8% = AU$350k ÷ AU$9.2m (Based mostly on the trailing twelve months to December 2021).

The ‘return’ is the annually gain. 1 way to conceptualize this is that for each and every A$1 of shareholders’ money it has, the company made A$.04 in gain.

What Is The Romance Concerning ROE And Earnings Growth?

We have previously proven that ROE serves as an economical profit-making gauge for a firm’s long run earnings. Centered on how much of its income the company chooses to reinvest or “keep”, we are then in a position to consider a company’s potential ability to deliver income. Assuming every thing else remains unchanged, the bigger the ROE and earnings retention, the better the progress rate of a organization in comparison to providers that never essentially bear these properties.

Rectifier Technologies’ Earnings Development And 3.8% ROE

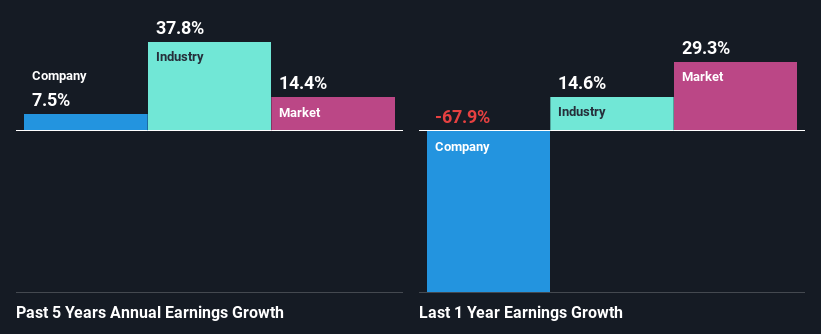

As you can see, Rectifier Technologies’ ROE looks very weak. Even when in comparison to the field ordinary of 12%, the ROE figure is very disappointing. However, the moderate 7.5% internet profits growth found by Rectifier Systems over the previous five decades is unquestionably a positive. Thus, the advancement in earnings could probably have been prompted by other variables. For occasion, the enterprise has a minimal payout ratio or is becoming managed efficiently.

We then in contrast Rectifier Technologies’ net revenue progress with the marketplace and observed that the company’s advancement determine is lower than the average sector growth charge of 24% in the similar time period, which is a little bit concerning.

Earnings growth is a huge variable in stock valuation. What investors have to have to identify future is if the anticipated earnings advancement, or the absence of it, is currently built into the share price tag. This then will help them figure out if the inventory is placed for a bright or bleak upcoming. Just one great indicator of predicted earnings expansion is the P/E ratio which establishes the value the sector is inclined to fork out for a stock centered on its earnings potential customers. So, you may want to test if Rectifier Systems is trading on a high P/E or a lower P/E, relative to its industry.

Is Rectifier Systems Using Its Retained Earnings Properly?

Although the company did spend out a part of its dividend in the previous, it at this time won’t spend a dividend. We infer that the corporation has been reinvesting all of its gains to develop its business.

Summary

On the total, we do really feel that Rectifier Technologies has some optimistic characteristics. Specifically, its respectable earnings advancement, which it realized thanks to it retaining most of its income. On the other hand, given the lower ROE, traders may well not be benefitting from all that reinvestment after all. Till now, we have only just grazed the floor of the firm’s past performance by on the lookout at the company’s fundamentals. You can do your possess research on Rectifier Systems and see how it has executed in the past by hunting at this Free of charge comprehensive graph of earlier earnings, revenue and hard cash flows.

Have comments on this post? Involved about the written content? Get in touch with us directly. Alternatively, email editorial-staff (at) simplywallst.com.

This post by Simply just Wall St is common in character. We deliver commentary dependent on historical data and analyst forecasts only working with an unbiased methodology and our content articles are not supposed to be monetary information. It does not represent a advice to purchase or sell any inventory, and does not get account of your objectives, or your money condition. We goal to deliver you very long-term centered evaluation driven by basic knowledge. Be aware that our investigation could not issue in the hottest value-delicate company bulletins or qualitative material. Merely Wall St has no position in any shares stated.